|

|

|||||||||||||||||||||||||||||||||||||||||||||||

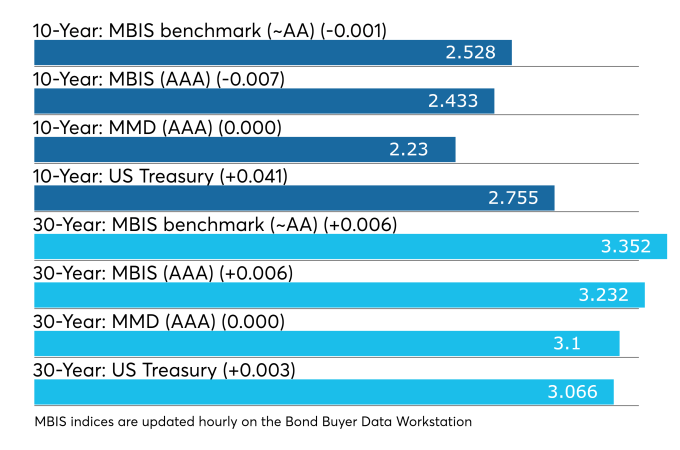

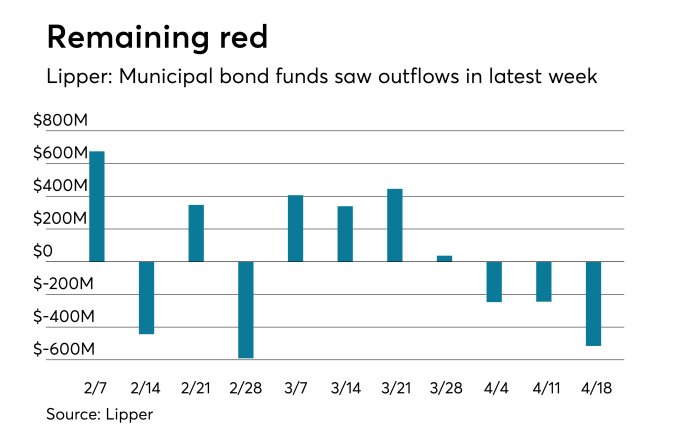

In The News Munis Major Selloff Reveals Ultra-Cheap Entry Point for Buyers By Elizabeth Rembert, Shruti Date Singh, Martin Z. Braun and Erin Hudson April 10, 2025, 2025-04-10 12:40:11 GMT (Bloomberg) -- Municipal bonds have become an attractive target for bargain-hunting investors after a historic rout pushed up yields. The sharp selloff in recent days drove muni benchmark yields up more than other areas of fixed income, making the tax-exempt bonds look like a particularly good deal. The yield on top-rated, 30-year benchmark bonds was 4.8% on Wednesday, the highest since 2011. For a wealthy investor in California to get the same value, a similar Treasury bond would have to offer a yield of 8.11%, after the tax exemption on the muni bonds is factored in â€" and the rates on US government debt are nowhere near that. "We're definitely getting to that point where people who don’t even care about the tax exemption may start to sniff", Andrew Clinton, chief executive officer of Clinton Investment Management, said earlier this week. The 30-year muni-Treasury ratio, a key measure of relative value, topped 100% on Wednesday, meaning the tax-exempt bonds were yielding more than taxable debt. That’s the cheapest since 2022, according to data compiled by Bloomberg. After the muni rout accelerated on Monday, banks that had not been active in the market began scooping up the cheap debt, according to multiple people familiar with the matter who declined to be named discussing private deals. Insurance companies have also been big buyers over the past few days, said other people with knowledge of the purchases. The gap remained wide even after the broader markets bounced back on Wednesday afternoon in response to the Trump administration’s 90-day tariff pause. That’s because muni investors tend to move more slowly than other asset classes. High-Tax States The trade was even more valuable for investors in high-tax states like New York and California. On Tuesday, New York City priced 10-year debt with a 3.81% yield. A 10-year Treasury bond would have to offer 6.44% to give investors the same tax-equivalent gains. In another example of juiced-up yields, one investor bought more than $5 million of tax-exempt California general obligation bonds with a 4% coupon at a yield of 4.28% on Wednesday. Last week, the state sold similarly-dated debt with a 3.67% yield. "This is the time when you want to be buying. When everyone is running away from the market, you want to be running toward the market," said Terry Goode, a senior portfolio manager at Allspring Global Investments. "You’re able to pick up good credits at adjusted yields that are higher and are attractive." When muni bonds were suffering their worst day in decades earlier this week, it wasn’t due to concerns about credit quality, according to investors and analysts. The primarily-retail investor base may have sold their holdings to buy stocks or raise cash as they ride out the wild volatility caused by President Donald Trump’s tariff plans. That uncertainty was compounded by seasonal factors, with the market pressured by high supply and less demand as investors tend to sell holdings to pay taxes. Michael Pietronico Been managing munis a long time today may be the worst single day I have ever seen - yields up 35 to 40 bps in spots. When it turns it will be a vicious rally don’t try and time get cash invested NOW. Sent via Twitter for iPhone. View original tweet. The rout brought on comparisons to the early days of the Covid-19 pandemic, when the market experienced violent swings, said Miller. "The two-day declines feel a lot like the worst two days at the start of the pandemic driven lockdowns, but potentially setting the stage for a major snap-back recovery,"he said. Municipal bonds are still a safe haven asset, according to Patrick Haskell, head of municipal bonds at BlackRock Inc. But, he said in an interview, “that doesn’t mean the price doesn’t move." --With assistance from Michelle Kaske and Amanda Albright. To contact the reporters on this story: To view this story in Bloomberg click here: Bloomberg Election: buy-siders brace for sweep, hope for divided government By Caitlin Devitt October 29, 2024, 11:12 a.m. EDT 5 Min Read The key question for municipal market investors heading into next week's tight federal election is less about who wins and more about by how much. Next year promises to be significant for tax policy and a sweep by either party poses greater risks to the muni market than a divided government. The margins of control of the House and Senate will also help determine the size and scope of potential tax law changes that will affect demand for tax-exempt paper. Even with a divided government, most experts expect to see tax changes as provisions of the 2017 Tax Cuts and Jobs Act expire at the end of the year and taxes will rise automatically if Congress does not act. Changes to corporate and individual tax rates, the alternative minimum tax and state and local tax deduction cap will all impact demand for tax-exempt paper. Last week's rise in rates indicates the market may already be pricing in a sweep. "The market is currently concerned that there may be a sweep with one party," said Michael Pietronico, CEO, senior portfolio manager and credit analyst for Miller Tabak Asset Management. "The bond market generally does not like one-party rule because there's no real checks and balances on the spending side," Pietronico said. "From our perspective, the balance of power being with one party is important to the bond market, and if the margin of victory is greater than expected that's a problem, because that's a mandate and they'll get fiscal stimulus through." To offset risks, Pietronico said his firm is continuing its year-long strategy of "barbelling" its portfolios with one-year and 12- to 15-year paper. "Over the next two weeks those shorter duration assets, in particular the one-year paper, will continue to outperform until there's some clarity on the election outcome," he said, adding that the market is hoping to wake up the day after the election knowing "who won, and by how much." The rise in rates since the Federal Reserve's September decision and the recent "bearish" yield curves suggest the market could be "pricing in a Trump victory and perhaps even a clean sweep by the Republican party," said Wells Fargo's head of municipal strategy Vikram Rai in an Oct. 28 client call. The firm considers the most likely election outcomes to be either a Trump-led sweep of Congress or a Harris victory with a divided Congress. A Republican sweep could "cause the curve to parallel shift up by 25 to 50 basis points, while a Trump presidency, even with a divided Congress, is likely to bear steepen the curve by about 25bp," Rai said. "Both scenarios will be negative for fund flows which is likely to pressure municipal performance," he said. Regardless of who takes the White House, a divided government makes the prospect of fiscal expansion "more muted," Rai said. "In the event of a Harris win, either with a divided Congress or unified one, we expect the market will price out expectations of a dramatic fiscal expansion." With seven days to go before the election, polls show ultracompetitive races for the White House and the House and a Republican edge for the Senate. UBS Wealth Management, in an Oct. 23 report, put the odds of a Harris victory with a split Congress at 45% and a Trump win with a split Congress at 35%. The prospect of a Republican sweep is at 15% and a Democrat sweep at 5%. "The outcome is almost entirely dependent on voter turnout," UBS said. The market has considered what a red wave or blue wave would mean, but there's a "high probability" that will not happen, according to the pundits, said Sheila May, director of Municipal Bond Research at GW&K Investment Management. The general consensus is this will be a very close election, with pundits predicting a split Congress with a "thin majority" in each chamber, she said. "If there was any deviation in away from that, any big surprise one way or the other, especially in the makeup of Congress, that could throw the market a little," May said. Narrow control would mean more clout for a group of bipartisan lawmakers from big-tax states like New York and California whose top priority is lifting or eliminating the $10,000 state and local tax deduction cap, said Kyle Pomerleau, senior fellow at the American Enterprise Institute, during an Oct. 23 election webinar hosted by Tax Analysts. If the margins are slim, "the SALT Caucus becomes much more important," Pomerleau said. "If the Republicans get a broad majority, they're going to be less important." He added that it's unlikely that the cap is totally eliminated given that "the math is so challenging already ... it's hard for me to imagine they'll want to make the math even harder." If Democrats take the House, Rep. Richard Neal, D-Mass., long considered a muni supporter, would likely return as chair of the House Ways and Means Committee. Republican control of the Senate could put Sen. Mike Crapo, R-Idaho, atop the Senate Finance Committee. Crapo is reportedly considering a workaround to the estimated $4 trillion cost of extending expiring TCJA provisions by arguing that simply extending current law does not require offsets. The philosophy could lessen threats to the municipal bond tax exemption. When Trump won in 2016, the market cheapened significantly, with the ten-year BVAL AAA cheapening by 75bp between Oct. 31 and Dec. 1, recalled Patrick Luby, senior municipal bonds strategist at CreditSights. "'Cautious' will be the watchword" for portfolio managers around the election, Luby said. "If there's extreme volatility coming out of the election and it is adverse to a portfolio manager's performance, it could really hurt them in the fourth quarter and potentially for the year," he said. BofA noted in an Oct. 18 report that one-party control returns for the ICE BofA Muni Master Index, a broad measure of the tax-exempt, fixed-rate market, "have been weaker on a weighted average basis (9.88%) than divided control returns (28.00%)." The strongest weighted average return was under a Republican-controlled Congress with a Democrat occupying the White House, BofA found. "The current makeup of control — Republican control of the House, Democrat control of the Senate and White House — is second strongest by return, with a weighted average total return of 24%." According to research from The Bond Buyer, 56% of municipal finance professionals said high interest rates should be an urgent priority for the next administration and Congress. The survey found that 41% of respondents said a Trump presidency would have a "very negative" effect on the industry. That compares to 19% for a Harris victory. Another 35% said a Harris victory would have a "somewhat positive" effect on the industry, with only 16% saying the same for a Trump win. Only 3% said that a Trump victory would carry no expected impact, while 16% said a Harris victory would have no expected impact. Jessica Lerner contributed to this report. Caitlin Devitt Senior Reporter, Infrastructure, The Bond Buyer For reprint and licensing requests for this article,click here. Election 2024 Washington DC Politics and policySecondary bond market Munis firmer, underperform UST rally post-FOMC By Jessica Lerner Municipals were firmer Wednesday but underperformed a U.S. Treasury rally after the Fed held rates steady. Equities rallied as well. The municipal market was up "a touch" after the Fed announced it would keep rates unchanged at their November meeting, according to Michael Pietronico, chief executive officer at Miller Tabak Asset Management. Commenting on the Fed's statement that a December hike is less likely due to tighter financial and credit conditions weighing on the economy, Pietronico said on X, formerly known as Twitter, Wednesday afternoon that the Fed is "basically admitting [the] bond market did the dirty work with the spike in yields." The acknowledgement the tightening of financial conditions, and not just credit, may lead some to take this "as a sign that the bond market will continue to help them with this tightening cycle, which could support the argument that a peak in rates is in place," said Edward Moya, senior market analyst at The Americas OANDA. Triple-A yields fell two to four basis points on the day while USTs rallied up to 15 basis points. As a result of falling yields, muni-UST ratios rose. The two-year muni-to-Treasury ratio Wednesday was at 73%, the three-year was at 74%, the five-year at 74%, the 10-year at 74% and the 30-year at 92%, according to Refinitiv Municipal Market Data's 3 p.m., ET, read. ICE Data Services had the two-year at 73%, the three-year at 74%, the five-year at 72%, the 10-year at 73% and the 30-year at 89% at 3:30 p.m. Municipal mutual fund losses intensified last week as the Investment Company Institute Wednesday reported investors pulled $2.280 billion from the funds in the week ending Oct. 25 after $1.291 million of outflows the previous week. BB110223-ICI.jpeg Exchange-traded funds, though, saw another week of inflows to the tune of $666 million after inflows of $552 million the week prior, according to ICI. October in the red "October's price performance resulted in a triple — that is, the third consecutive monthly loss of the year and ironically mirroring how August, September and October 2022 performed," noted Kim Olsan, senior vice president of municipal trading at FHN Financial. "Price weakness created a short(er) and safe(er) bias during the month, as supply overwhelmed available reinvestment flows and mutual fund redemptions of $9 billion across four weeks left bidders in control." Municipal losses continued in October. The Bloomberg Muni Index posted a negative 0.85% return in October and losses of 82.22% year to date. High-yield lost 1.60% for the month and 1.60% for 2022 while taxables lost 2.05% in October and 1.19% in 2022 so far. Olsan noted the rate volatility throughout October gave more strength to secure sectors. The general obligation index lost 0.6% but a broad revenue index gave up just shy of 1%. Olsan pointed out that as revenue bond issuance increased 70% from a year prior — four of the five largest deals in October were revenue credits — GO issuance fell 11%. "Year-to-date results have still favored revenue bond allocations with a 50 basis point excess gain to the GO index, indicative of a 13% decline in supply while GO issuance is essentially flat to 2022," she said. The safer approach was evident in how sub-sectors within the revenue category performed, she said. A water/sewer bond index lost 0.8%, "matching the broad market result," she said. Contrasting that, healthcare was down 1.6% and transportation bonds lost 1%. "What appears to have occurred during the month is a risk-off shift in allocations relative to supply conditions — water/sewer volume is down 6% while healthcare supply is off 50% and transportation issuance has fallen 24%," Olsan said. Taxable munis ended October with losses of 2% which moved 2023 returns into the negative by 1.1%. "Comparative returns in taxable sectors placed munis at the higher end of losses — a UST index lost 1.2%, the U.S. Aggregate index closed the month down 1.5% and a US MBS index loss matched that of the taxable muni index," Olsan noted. The short-end (one to two-year) once again closed in the black and Olsan pointed out it is the only muni category positive for the year. Intermediate durations fared better than long-term bonds, posting a loss of 0.6% to the 2% loss of the long index, she said. "At end of 10 months, a 200 basis point selloff in the 30-year spot has moved the year-to-date loss to nearly 4%," Olsan said. In the primary market Wednesday, RBC Capital Markets priced for the Connecticut Housing Finance Authority (Aaa/AAA//) $190.125 million of social housing mortgage finance program bonds, 2023 Series D, with all bonds pricing at par — 3.8s of 11/2024, 4.1s of 5/2028, 4.15s of 11/2028, 4.55s of 5/2033, 4.6s of 11/2033, 4.9s of 11/2038, 5.125s of 11/2043 and 5.35s of 11/2048 — except 6.25s of 5/2054 at 5.00%, callable 11/15/2032. Secondary trading California 5s of 2024 at 3.76%-3.74% versus 4.00% Tuesday. Maryland 5s of 2024 at 3.73%-3.58% versus 3.74% on 10/25. Minnesota 5s of 2025 at 3.69%. Georgia 5s of 2028 at 3.51%-3.50% versus 3.52%-3.53% on 10/25 and 3.54% on 10/20. California 5s of 2029 at 3.62% versus 3.61% on 10/26. Maryland 5s of 2029 at 3.60% versus 3.60% on 10/23. California 5s of 2033 at 3.71%-3.70% versus 3.71% on 10/25. DC 5s of 2033 at 3.69% versus 3.73% Monday and 3.78% Friday. Delaware 5s of 2034 at 3.60%-3.58%. California 5s of 2033 at 3.71%-3.70% versus 3.71% on 10/25. DC 5s of 2033 at 3.69% versus 3.73% Monday and 3.78% Friday. Delaware 5s of 2034 at 3.60%-3.58%. AAA scales Refinitiv MMD's scale saw bumps throughout most of the curve: The one-year was at 3.74% (-2, no roll) and 3.65% (-2, no roll) in two years. The five-year was at 3.49% (-2, no roll), the 10-year at 3.58% (-4, +1bp Nov. roll) and the 30-year at 4.57% (unch) at 3 p.m. The ICE AAA yield curve was bumped two to three basis points: 3.72% (-2) in 2024 and 3.70% (-2) in 2025. The five-year was at 3.51% (-2), the 10-year was at 3.56% (-2) and the 30-year was at 4.54% (-3) at 3:30 p.m. The S&P Global Market Intelligence municipal curve was bumped up to three basis points: The one-year was at 3.77% (-2) in 2024 and 3.69% (-2) in 2025. The five-year was at 3.54% (-2), the 10-year was at 3.59% (-3) and the 30-year yield was at 4.58% (unch), according to a 3 p.m. read. Bloomberg BVAL was cut bumped one to two basis points: 3.78% (-1) in 2024 and 3.72% (-1) in 2025. The five-year at 3.51% (-1), the 10-year at 3.61% (-1) and the 30-year at 4.57% (-2) at 3:30 p.m. Treasuries rallied. The two-year UST was yielding 4.949% (-12), the three-year was at 4.769% (-12), the five-year at 4.670% (-15), the 10-year at 4.759% (-13), the 20-year at 5.128% (-10) and the 30-year Treasury was yielding 4.944% (-10) near the close. FOMC With a wary eye on inflation, and acknowledging a stronger economy and, the Federal Open Market Committee held its interest rate target at a range of 5.25% to 5.50%. "Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation," the panel's post-meeting statement said. "The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks." In his press conference, Chair Jerome Powell reiterated the panel would "proceed carefully" and decisions would be made on "a meeting-by-meeting basis." The Fed does not see a recession in the near term, Powell said, and they are not yet discussing rate cuts. The statement "marks the official end of the hiking cycle," said Thomas Holzheu, Swiss Re chief economist for the Americas. "The sharp rise in long-term bond yields has reduced the need for further rate hikes as tighter financial conditions can substitute for a higher terminal policy rate." The war in Israel will lead to volatile oil prices into next year, he said, and while this will not cause the Fed to raise rates, it could "delay the start of the easing cycle further out into 2024 and potentially 2025 if inflation pressures reaccelerate." The statement was neither hawkish or dovish, according to Morgan Stanley economists, since rates were held and the Fed added "financial conditions" to the list factors that could "weigh on the economy." "The statement acknowledges the recent pick-up in growth and the resilience in hiring," noted Fitch Ratings Chief Economist Brian Coulton. "There was a notable absence of any reference to the backup in bond yields since the last FOMC meeting. Chair Powell has repeatedly warned of the risks to achieving the FOMC'S inflation goals if growth picks up and the labor market stays tight. And with core CPI services inflation still at 5.7% and wage growth only falling gradually, we still expect one more hike in this tightening cycle." Despite the vibrant third quarter GDP number and a strong labor market, Mortgage Bankers Association SVP and Chief Economist Mike Fratantoni said as "long as inflation continues to come down, the Fed is likely to pause at this level for some time. We expect its next move will be a cut in next year's second quarter." Disinflation will continue and the Fed will likely keep rates steady into next year, said Whitney Watson, global co-head and co-chief investment officer of fixed income and liquidity solutions at Goldman Sachs Asset Management. But "there are risks in both directions," Watson warned. "The rise in inflation expectations, owing to higher gas prices, combined with strong economic activity, preserves the prospect of another rate hike. Conversely, a more pronounced economic slowdown caused by the growing impact of higher interest rates might accelerate the timeline for transitioning to rate cuts." The Fed is likely done with its hiking cycle, said Bryce Doty, senior vice president and senior portfolio manager at Sit Investment Associates. "This paves the way for the yield curve to continue to normalize and move toward an upward slope, especially from 2-year Treasury maturities on out. This will most likely happen with both 2-year maturity yields declining and 30-year maturity yields rising." The Fed is trying to "reduce consumer and aggregate demand but not so much as to cause a recession that leads to painfully high unemployment," noted Lon Erickson, portfolio manager at Thornburg Investment Management. "They need all the luck in the world." But there were few clues as to future moves, said BMO Deputy Chief Economist Michael Gregory. "In the presser, Powell even avoided saying the Fed had a formal 'tightening bias.'" While the FOMC maintains a meeting-by-meeting approach, to "assess whether it has achieved sufficiently restrictive monetary policy," he said, "the Fed judges it's not there yet, but financial conditions are working to steer them in that direction. We'll see where this lands by mid-December, after a couple iterations of key data." Primary to come The Avon Community School Building Corp. (/AA+//) is set to price Thursday $150 million of ad valorem property tax first mortgage bonds, Series 2023, serials 2027-2043. Stifel, Nicolaus & Co. Christine Albano and Gary Siegel contributed to this report. -0- Nov/01/2023 19:56 GMT To view this story in Bloomberg click here Munis can offer 8% taxable equivalent yields if investors dive in now By Christine Albano The last time the triple-A 30-year muni was consistently over 4%, Barack Obama was president, lawmakers were squabbling over whether to raise the debt ceiling, cut spending and keep the federal government open, which eventually resulted in a downgrade of the United State's triple-A rating by S&P Global Ratings. While there is a different administration, certain dysfunctional factors are still at play in Washington, as lawmakers are again at loggerheads on spending, the debt ceiling and whether to keep the government open. The U.S. lost another triple-A rating, this time from Fitch Ratings. Adding in major macroeconomic uncertainties and severe geopolitical turmoil, volatility has been the theme for bond markets. As participants have worked through various challenges, muni "yields are the highest in over a decade and ratios, though not cheap, are attractive," said Chris Brigati, most recently senior vice president and managing director of municipal strategy at Valley Bank in Morristown, New Jersey. Chris Brigati Chris Brigati, head of municipal trading at Advisors Asset Management "If you haven't already, it's worth starting to dip a toe in the water," he said. In the summer of 2011, interest rates for the triple-A, 30-year municipal yield were as high as 4.35% on June 30, according to Refinitiv MMD. The same benchmark was yielding 4.36% on Tuesday, falling to 4.24% as of Friday. That is up significantly from four months earlier when it was yielding 3.49% on June 30. Outside of triple-As, elsewhere in the high-grade spectrum, yields are even more attractive, Brigati noted. On Friday, double-A rated municipal yields were at 4.55% and the single-A rated yield was at 4.79%, according to Refinitiv. The 30-year U.S. Treasury was at 4.79% Friday morning. The recent rise in yields has created an opportunity for those investors waiting to "jump into the market," Roberto Roffo, portfolio manager at SWBC Investment Company, said Wednesday. "While ratios show that municipal bonds are approximately 90% of Treasuries, buying double-A or even A-rated bonds allows investors to purchase bonds cheaper than current Treasury bonds," Roffo said. "Considering that municipal bonds are the second safest fixed income asset class behind Treasuries, investors are taking minimal risk to achieve tax-free yields above Treasuries," Roffo said. With the taxable equivalent yield taken into account, it makes municipal bonds look even more attractive, he noted. For example, an investor in the top tax bracket purchasing an A-rated bond at a 5.25% yield will earn a tax-equivalent rate of approximately 8.70%, Roffo pointed out. "Considering the safety of municipal bonds, no other asset class comes close to being so attractive" in the current market, Roffo added. Others agreed the taxable equivalent yield offered by attractive investment-grade municipal paper speaks volumes in terms of value and opportunity. Michael Pietronico, chief executive officer at Miller Tabak Asset Management, called the opportunity "a generational buy in our view." "As intermediate buyers out to only 15 years on the yield curve, we are enjoying locking in 5% tax-free yields when they show up in the secondary market," he said Wednesday. Michael Pietronico, CEO of Miller Tabak Asset Management Credit: vpietronico "That yield brings the taxable equivalent yield to almost 8%, which covers the current rate of inflation quite well," Pietronico added. The current yield range allows investors to take advantage of both a historic and cyclical opportunity, Brigati said.

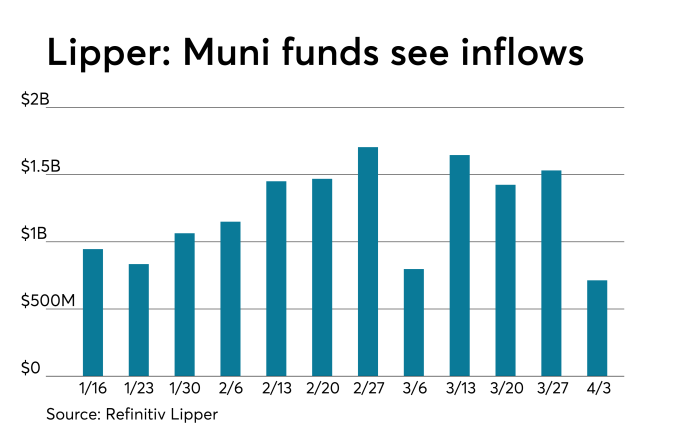

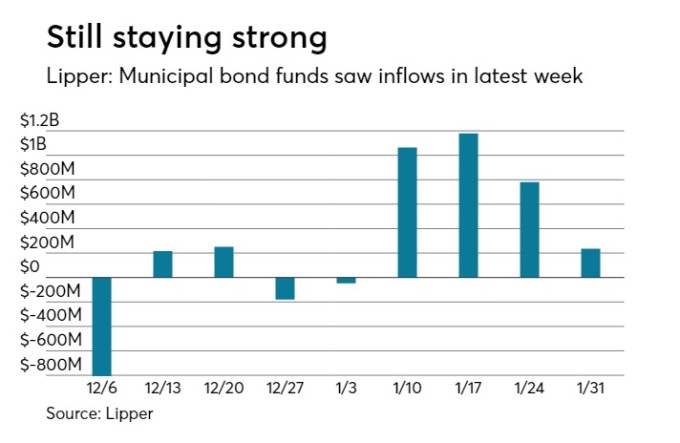

"Municipal yields have been playing catch-up with Treasuries and are gapping wider, as is typical in the September/October time period," he noted. Brigati said investors can lock in better than 7% tax-equivalent yield on high-grade municipals in the current market. Municipals tend to get cheaper in the fall, but besides the cyclical opportunity, absolute municipal yields have cheapened 30 basis points more than Treasuries in the last few weeks, Brigati noted. Brigati expects this buying trend could potentially last through year end, and 5% coupons at par could become readily available. "It's a cyclically interesting time relative to other times of the year," Brigati said. "It tends to be a little bit of a supply-demand dynamic," he said. "The market is cheaper because there is more available to buy," Brigati added. Thirty-day visible supply is at more than $16 billion, per The Bond Buyer data. One of the popular structures that retail investors like in the current market is 5% coupons that are trading at yields in the ballpark of 4.75% to 4.90%, according to Brigati. "It's a historically interesting time for retail buyers who prefer 5% bonds at a discount to par, or at par, and we're close to being there," he said. With an inverted yield curve in the municipal market, investors are trending toward extending their maturities to take advantage of the current yields. "People want to lock in down the curve," as the "sweet spots" are 10 to 15 years with three- to seven-year calls, and 15 to 20 years with a 10-year call. "That is an attractive spot and where a lot of people are trying to participate," he said of the 15- to 20-year slope. Investors, he noted, can earn close to 5% yields and lock those yields in with the added protection of a 10-year call. "There has not been an opportunity to do that in quite some time," Brigati said, reiterating the decade-long gap in attractive yields dating back to 2011-2012. That was before the Federal Reserve Board's zero interest-rate policy to promote economic stimulus, and long before the COVID pandemic, he noted. "They were in a stimulating environment and aggressive in doing anything they could to keep the economy stimulative," Brigati said of the Fed. That 10-year rally ended in 2022 when the central bank started raising short-term rates, and became much more defensive, Brigati noted. "They were raising rates and that caused the yield curve back up, as a result, and created a buying opportunity for investors not seen in a long time," he said. According to Brigati, investors should grab the chance to earn attractive yields now, as he said the advantageous climate might stick around only through early November. "It's not a two- to four-day thing," he said, noting that the timing of the window of opportunity depends on the upcoming Fed meetings, the next of which is scheduled to end on Nov. 1. The Federal Open Market Committee held rates steady during its most recent meeting in September. The FOMC raised interest rates to 5.25%–5.50% at the July 2023 meeting, marking 11 rate hikes this cycle aimed at curbing high inflation. "This is a bigger-picture, cyclical thing," Brigati said of the attractive yield climate. "Investors should dip their toe in in case the Fed has done enough and feels comfortable with rates," Brigati said. "That could cause the yield curve to rally." On the flipside, if the Fed does not come out with a stance, and they raise interest rates to 7%, the buying opportunity will get even better as rates increase, according to Brigati. That is the chance investors have to take, he said. "Are you getting in early; could they get more attractive?" Brigati asked. The answer to both questions, he said, is yes. But, if historical patterns prevail, most investors believe that locking in 5% tax-free yields for high-grade paper is attractive. He said investors who allocate some money into the current market can always take advantage of the cyclical and historical benefits and tweak their game plan later. Besides the beneficial yield climate, Brigati added, it is also a good time for investors to consider tax-loss swaps. "They can use the losses in their portfolios to harvest them toward gains in the stock market," Brigati added. This will allow investors to reestablish their portfolio at the current absolute higher yields and prepare for the future. "They will be buying attractive bonds at attractive levels on longer-duration, higher yields, while swapping tax losses with equity gains," he said. -0- Oct/13/2023 17:53 GMT To view this story in Bloomberg click here Muni mutual fund inflows are back again 2023-08-31 19:55:03.31 GMT Municipals were steady to firmer in spots to close out August as inflows returned to muni mutual funds. U.S. Treasury yields fell and equities were mixed ahead of Friday's employment report. Triple-A benchmarks were bumped up to three basis points, depending on the scale, while UST yields fell three to four basis points. The two-year muni-to-Treasury ratio Thursdsay was at 65%, the three-year at 66%, the five-year at 68%, the 10-year at 72% and the 30-year at 92%, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the two-year at 64%, the three-year at 66%, the five-year at 66%, the 10-year at 69% and the 30-year at 91% at 4 p.m. Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday after $534.428 million of outflows into the funds the previous week. The tone and climate of the municipal arena were positive on Thursday as the market prepared to bid farewell to summer ahead of the long Labor Day holiday weekend. "The market is quiet with a firm tone, however, there are not enough trades to point to," a New York trader said on Thursday. "Quiet but constructive tone, with prices steady" is how Michael Pietronico, chief executive officer of Miller Tabak Asset Management, described the market Thursday. "Expectations for next week are neutral as the shortened week should usher in minimal volatility," he said. Next week will have a constructive tone, said Pat Luby, a CreditSights strategist., as a fair amount of redemption money will be available to investors Friday. On Friday, $21 billion of principal and interest will be paid out, consisting of $15 billion of principal and $6 billion of interest, Luby said. California will see the largest principal payouts with $3.7 billion, followed by Texas with $1.4 billion and Georgia with $1.3 billion, he noted. "So that money should be burning a hole in investors' pockets on Tuesday when they come back," he said. The positive tone is largely due to market-friendly data pointing to more subdued economic growth, according to Jeff Lipton, head of municipal credit and market strategy at Oppenheimer & Co., who said municipals were on firm ground along the curve starting Wednesday. Overall, market technicals were pointing to good participation before trading halted ahead of Labor Day. "Institutional buyers have money to put to work and we are seeing particular activity along the first 10 years of the curve," Lipton said. "Although the new-issue competitive market began the week with a cheaper bias, mid-week revealed noted strength with better support." For much of the August selloff, he said municipals displayed "performance anxiety" with the asset class now significantly underperforming U.S. Treasuries. Ratios are relatively attractive in the secondary given the underperformance, according to Lipton. On the retail front, mom-and-pop investors are preferring the "4% parish structures and 5% coupon, good quality, with a low dollar price and 4.40%-plus yield to maturity," he noted. "This environment should cultivate more retail interest with sidelined cash being more actively invested," Lipton added. In August, "the tax-exempt market was somewhat just starved for bonds," said Wesly Pate, senior portfolio manager at Income Research + Management. "The lack of supply is really starting to weigh on many factors." "Whenever we're seeing pressures in other asset classes, they're not quite reverberating into the municipal class, just given the fact that overall market turnover is a little bit subdued just because of the lack of supply," he said. That is starting to dampen overall volatility, and keeping things a bit more range-bound than what they normally would be, Pate noted. That lack of supply in August, down 13% from 2022, has reduced the amount of turnover in the market. "As market participants are looking at bond availability, they're saying, 'Well, if there are fewer bonds to choose from, I'm not going to sell bond A in the hopeful desire to replace it with bond B because the availability of bond B is becoming incrementally less certain,'" he said. That is starting to have a meaningful impact on the market in terms of valuations and overall trading activity, he said. But overall, Pate said August has seen a "rather tame environment." "Most recently, we've settled into a level of rates and that's starting to give a little bit more transparency into what the future looks like, and that's given the market a lot of confidence going forward," he said. With fund flows not being "meaningful" in either direction, Pate said "it's going to be a supply picture in terms of the technical environment." Whenever there is growing demand but "limited supply and actually reduced supply, and we look compared to the last couple of years, technicals are arguably what's driving the market." With August over, others looked toward the fourth quarter with optimism. "We are hoping September is better than August, which underperformed Treasuries," a New York trader said. "September and October are much softer reinvestment months, so we don't expect a strong municipal market if supply picks up," he said. The 30-day Bond Buyer visible supply stands at $9.6 billion. "Technicals should be constructive throughout September," he said. "We are not ruling out momentary weakness, but we do think that munis are poised for better performance, and at current nominal yields, they offer attractive income opportunities against a favorable credit backdrop," Lipton said. In September, issuance will ramp up, according to Luby. Next week will see a $2.6 billion California GO deal, which will do "pretty well." In two weeks, he said the new-issue calendar will pick up even more with several large deals already on the schedule. Secondary trading: Washington 5s of 2024 at 3.28%. Ohio 5s of 2024 at 3.32% versus 3.37%-3.32% Wednesday. Maryland 5s of 2025 at 3.14%.NYC 5s of 2027 at 2.97%. LA DWP 5s of 2029 at 2.72%. Connecticut 5s of 2030 at 2.99%. Minnesota 5s of 2032 at 2.94% versus 3.03%-3.00% Tuesday and 2.74% original on 8/15. Tennessee 5s of 2033 at 3.01%-2.83% versus 3.05% on 8/21 and 2.97%-2.95% original on 8/16. DASNY 5S OF 2035 AT 3.25%-3.24% versus 3.31%-3.32% on 8/24 and 3.23%-3.22% on 8/17. Washington 5s of 2046 at 4.03%-4.05% versus 4.06% Tuesday and 4.08% on 8/23. Harris County, Texas, 5s of 2048 at 4.14% versus 4.09%-4.08% on 8/15 and 4.06%-4.01% original on 8/9. AAA scales: Refinitiv MMD's scale was unchanged: The one-year was at 3.25% and 3.14% in two years. The five-year was at 2.88%, the 10-year at 2.93% and the 30-year at 3.88% at 3 p.m.The ICE AAA yield curve was bumped two to three basis point: 3.24% (-3) in 2024 and 3.17% (-3) in 2025. The five-year was at 2.84% (-3), the 10-year was at 2.83% (-3) and the 30-year was at 3.85% (-2) at 4 p.m. The S&P Global Market Intelligence (formerly IHS Markit) municipal curve was unchanged: 3.26% in 2024 and 3.14% in 2025. The five-year was at 2.89%, the 10-year was at 2.94% and the 30-year yield was at 3.87%, according to a 4 p.m. read. Bloomberg BVAL was bumped one to two basis points: 3.23% (-2) in 2024 and 3.14% (-1) in 2025. The five-year at 2.85% (-1), the 10-year at 2.85% (-1) and the 30-year at 3.84% (-1) at 4 p.m. Treasuries were firmer: The two-year UST was yielding 4.852% (-4), the three-year was at 4.541% (-4), the five-year at 4.236% (-4), the 10-year at 4.092% (-3), the 20-year at 4.393% (-3) and the 30-year Treasury was yielding 4.201% (-3) near the close. Mutual fund details: Refinitiv Lipper reported $407.976 million of inflows from municipal bond mutual funds for the week ending Wednesday following $534.428 million of outflows the week prior.Exchange-traded muni funds reported inflows of $759.794 million versus $105.005 million of outflows in the previous week. Ex-ETFs muni funds saw outflows of $351.818 million after $429.422 million outflows in the prior week. Long-term muni bond funds had $676.451 million of inflows in the latest week after outflows of $297.863 million in the previous week. Intermediate-term funds had $50.794 million of outflows after $72.381 million of outflows in the prior week. National funds had inflows of $522.487 million versus $496.381 million of outflows the previous week while high-yield muni funds reported inflows of $62.681 million versus inflows of $28.271 million the week prior. -0- Aug/31/2023 19:55 GMT To view this story in Bloomberg click here S&P slashes Chicago suburb's GO rating over default event on unrated bonds February 01, 2023, 4:32 p.m. EST Twitter Bolingbrook, Illinois, was downgraded seven notches by S&P Global Ratings, which cited the Chicago suburb's unwillingness to cover shortages on unrated sales tax revenue bonds as a management and governance risk. The village of 73,000said the downgrade "sets a harmful and disruptive precedent for any credit secured by specific revenues that do not pledge the taxing power of the related municipality." S&P cut the village's underlying GO rating to BBB-minus from AA Thursday as rebuke for failing "to support a capital obligation" by missing five sinking payments owed on a January 2024 term bond from the $47.7 million unrated 2005 issue.

The bonds are secured by sales tax revenues in a specially designated area for a retail development project. The missed sinking fund deposits that began in 2020 were disclosed in October by the bond trustee and trigger an event of default under the bond indenture.

"The likelihood of default upon the term bonds maturity results in a weaker management assessment for the village under our criteria," S&P analyst Andrew Truckenmiller said. "As a result of the weaker management score, our rating on the village's GO debt is capped" at BBB-minus. The village has $200 million of direct debt. The outlook on the GOs is stable. The village government told S&P that pledged revenues will likely fall short of meeting both the 2024 and 2026 term maturities and the village lacks a formalized plan to use other available resources to satisfy the debt service obligations. Those factors drive a weaker management assessment and raise governance risk under S&P's local government criteria with Bolingbrook labeled as "vulnerable" under those metrics. "The recurring events of default under the trust indenture and the likelihood that the village will default upon the term bonds maturity represents a weak risk management, culture, and oversight governance in our opinion," Truckenmiller said. "In our view, the 2005 sales tax bonds are obligations of the village and a lack of support for them reflects weak governance practices." S&P's local government GO rating methodology which has been in place since 2013 guided the action and has resulted in similar actions for other GO credits, analysts said. Environmental, social, and governance credit factors for the change fall under "risk management, culture, and oversight." Village officials criticized S&P's decision and appealed the rating committee's decision when first notified. "The village disagreed with S&P's application of its 'U.S. Local Governments General Obligations Ratings' methodology and provided substantial evidence of why negative performance on a standalone credit unrelated to the village's issuer credit rating should not impair its ICR on appeal. S&P denied that appeal," said a statement emailed by village Finance Director Rosa Cojulun. The statement noted that the unrated bonds were sold to sophisticated buyers based on the project's risk and limited scope of the pledge and that the limited offering memorandum included substantial language disclosing that the bonds are neither a debt, liability, general obligation or even a moral obligation of the village. The Series 2005 bonds paid interest rates of 5.75%, 6.25%, and 6% on 2015, 2024, and 2026 term maturities, respectively, and are also not subject to any continuing disclosure rules."The village believes S&P's rating action attempts to cause a de facto conversion of the Series 2005 Bonds to a general obligation of the village by force of its downgrade," the statement read. "The village believes this is a misapplication of its rating criteria and further sets a harmful and disruptive precedent for any credit secured by specific revenues that do not pledge the taxing power of the related municipality." The village statement goes on to say it would consider using general revenues to cover the shortages a "poor financial management" that "would benefit a few sophisticated investors to the detriment of thousands of taxpayers in the village of Bolingbrook." The bonds were issued to help finance a retail center anchored by a Bass Pro Shop and a Macy's, as part of a sales tax district that also included an already operating Ikea store, the offering memorandum said.

Pledged revenues have fallen short of projections needed to meet debt service demands and reserves have been exhausted leading to a shortage of approximately $2.6 million, according to S&P. About $20 million remains outstanding. The village holds a healthy general fund balance of $50 million which is equal to 64% of revenues, so "the village's lack of action to support the 2005 sales tax revenue bonds reflects an unwillingness, not an inability, to pay debt service on time and in full," S&P said. The report gives the village high financial marks but "very weak management" and "very weak debt and long term liabilities" grades. S&P said Bolingbrook's rating may be downgraded to junk if debt service is not paid in full on the sales tax revenue bonds or if the fallout from the potential 2024 term bond default pressures the village's operations, budgetary flexibility, or liquidity profile. S&P could lift the BBB-minus cap and reward the village with a multi-notch cap if officials demonstrate a willingness to pay all debt service requirements in full and on time. S&P noted that many of the GO issues carry bond insurance from Assured Guaranty. "It would be safe to assume this credit will have difficulty gaining market access in the future," said Michael Pietronico, chief executive officer at Miller Tabak Asset Management, who had noticed the missed sinking fund deposits but does not hold Bolingbrook bonds. Moody's assigns its A2 underlying rating to Bolingbrook GOs. The Bolingbrook situation provides a reminder of the risk for investors associated with narrow pledges for project financings that don't carry a GO or appropriation pledge and the risk for borrowers who might believe their GO is insulated and won't suffer any fallout if a project financing falters. Yvette Shields, The Bond Buyer Munis Log Best Stretch of Gains Since August on Softer Inflation Thursday, November 16, 2022 (Bloomberg) -- The $4 trillion municipal-bond market is posting its best run in months, supported by diminished issuance and bets that ebbing inflation will give the Federal Reserve room to slow its interest-rate hikes. US state and city debt is on track for its seventh straight session of r on Friday after digesting nearly $10 billion in new issuance on the week. Supply is expected to drop to $5.5 billion in the upcoming week. After a week marked by a strong and steady secondary market, the triple-A muni benchmarks remained flat for the sixth straight session as Treasuries were little changed.

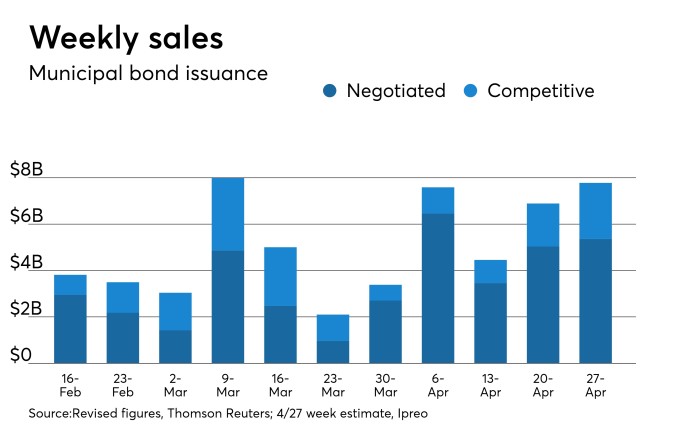

Volume is expected to fall to $5.5 billion, according to IHS Ipreo, in a calendar consisting of $4.2 billion in negotiated deals and $1.3 billion of competitive sales. "Municipal bonds absorbed new issue supply rather easily thanks to continued mutual fund inflows and a relatively stable U.S. Treasury market," said Michael Pietronico, chief executive officer at Miller Tabak Asset Management. While stocks fell on Thursday in reaction to President Biden's proposal to raise the marginal income tax rate to 39.6% from 37% and nearly double the capital gains tax to 39.6% for people earning more than $1 million, municipals remained steady, Pietronico said Friday. "The Biden proposal to lift tax rates on the wealthy also added to the positive tone for municipal bonds," he said. In light primary activity Friday, JPMorgan Securities priced $183.3 million Arizona Board of Regents revenue and revenue refunding bonds (Aa2/AA-minus/NR/NR) for the University of Arizona. With most of the week's largest deals completed, the market absorbed the hefty supply and continued to perform well, according to a New York trader. "All key deals have done well this week and yields lowered," the trader said, pointing to the $1 billion Connecticut special obligations bond deal priced Thursday which saw wide investor support. The pricing offered a 10-year yield of 1.21%, +30/AAA versus a pricing in May 2020 that was spread +120/AAA with a hefty 2.17% yield. Economic activity A dramatic increase in new home sales in March should translate into gains in durable goods orders, analysts said, as low mortgage rates partly offset builders passing on costs to buyers. New homes sales soared 20.7% to a seasonally adjusted 1.021 million level in March (the highest level since September 2006), from an upwardly revised February pace of 846,000 million, first reported as 775,000. Economists polled by IFR Markets expected 886,000 sales in the month. "I have to believe that either builders, buyers or both got a bit spooked by last month's rate rise and wanted to get going before they risked even higher rates or commodity prices," said Steve Sosnick, chief strategist at Interactive Brokers. "Virtually all of the cyclical and demographic factors underlying demand for homes are positive," according to Mickey Levy, Berenberg chief economist for the U.S., Americas and Asia. "Additional boosts are provided by the stay-at-home trend and rapid increases in prices, which lift expectations of further home price increases. Construction activity is expected to remain strong and overall housing activity is projected to rise significantly in 2021-2022." "The strength in home sales is adding significantly to consumption of household durable goods," he said. "This trend is expected to continue." Year-over-year sales are up 66.8%. "Properties are being snapped up after an average of only 18 days on the market, also a record low," noted Yelena Maleyev, economist at Grant Thornton. "Builders will continue to experience difficulty keeping up with demand, especially at the lower end of the market," she added. "Sales growth will continue to come from homes not yet built." Existing home sales, rIGN="JUSTIFY">"The long and slow selloff really started in early August 2020 when the 10-year AAA reached 0.58%, a record low, according to the MMD scale," they said. "By late March 2021, it peaked at 1.16%, and the entire selloff resulted in a doubling of the 10-year AAA yield. Our second quarter rally target of the 0.75% area represents a two-thirds retracement of the entire selloff." They added that the muni market rally this round has synchronized well with the Treasury market while ratios have stayed in the low ranges. "As we stated before, low ratios should prevail for much of the year and any blip should present a good opportunity on relative values," Li and Rogow wrote.

Secondary market Some notable trades on Friday included activity in the California's general obligation bonds. According to trades tracked by ICE, $4 million of Cal GO 5s of 9/1/2041 [13063DE53] traded at 130.632 (originally priced on April 20 as 5s at 130.115 to yield 1.71%); $4.765 million of forward delivery Cal 5s of 11/1/2031 [13063DZD3] traded at 135.686, a yield of 1.048% (originally priced on Oct. 21, 2020 as 5s at 134.239 to yield 1.33%); and $1 million of Cal 5s of 11/30/2034 [13063DA81] traded at 134.125, a yield of 1.22% (originally priced on March 11 as 5s at 133.042 to yield 1.35%). High-grade municipals were unchanged Friday, according to final readings on Refinitiv MMD's AAA benchmark scale. Short yields were steady at 0.50% in 2022 and 0.70% in 2023. Out longer, the yield on the 10-year muni was flat at 0.93% while the yield on the 30-year remained at 1.55%. The 10-year muni-to-Treasury ratio was calculated at 59.3% while the 30-year muni-to-Treasury ratio stood at 68.9%, according to MMD. The ICE AAA ue refunding bonds ( /AA/ / ) on Tuesday. The bonds are insured by Build America Mutual Assurance Co. and are being priced by bookrunner Piper Sandler. Muni yields climb 30-plus basis points in week-long sell-off Wednesday, February 24, 2021 Triple-A municipal benchmarks saw another seven basis point cut in yields on bonds outside of 10 years on Wednesday, pushing municipal to U.S. Treasury ratios higher amid sloppy trading and cheaper pricing levels on high-grade competitive deals. Municipal bonds could not ignore another rise in U.S. Treasury rates, Federal Reserve Board Chairman Jerome Powell's congressional testimony and a resulting equity rebound, along with approval of emergency use of a new COVID vaccine and the likelihood of more federal stimulus. "The municipal yield curve continues to steepen, and refuge from significant price losses only exists at the very short end of the market at this time," said Michael Pietronico, chief executive officer at Miller Tabak Asset Management. Municipal yields rose seven basis points on Wednesday to 1.09% in 10-years and 1.75% in 30, bringing Refiniv MMD benchmark yields in those maturities 33 basis points higher in one week.

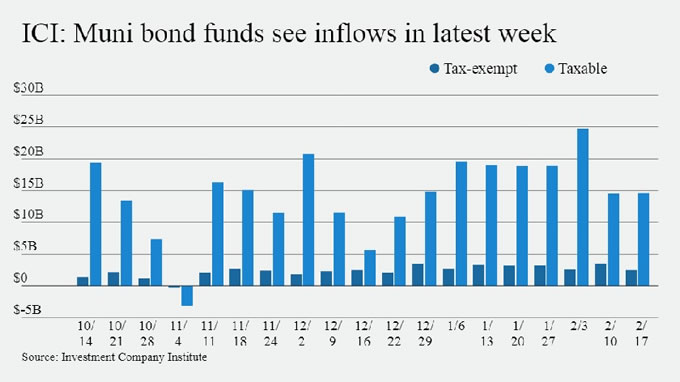

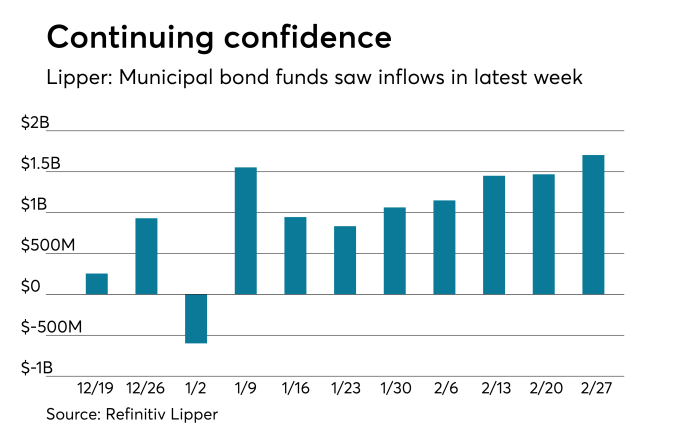

The 10-year muni/UST ratio is at 78.5% Wednesday and the 10-year at 77.6%, according to Refinitiv MMD. ICE Data Services showed ratios rose four basis points to 77% in 10 years and up two basis points to 79% in 30. BVAL showed 10-year ratios rose to 75% and at 79.6% in 30 years. The 10-year muni/UST ratio on Feb. 16, the day before the sell-off began, was at 54% and the 30-year was at 65%, according to MMD. "Muni/UST ratios have corrected a lot over the past 10 days, but even with the ongoing inflows it still feels like there is a bit of room to go," said Greg Saulnier, municipal analyst at Refinitiv MMD. He noted 1% in 10-years and 2% in 30 years started to provide some footing Tuesday, "but with rates selling off today after the J&J vaccine news, it looks like it added another leg lower for munis." The Investment Company Institute reported $2.517 billion of inflows into municipal bond mutual funds for the week ended Feb. 17. Flows from Refinitiv Lipper to be reported Thursday may be more telling of how the sell-off has affected the funds, as ICI reports lag and Wednesday's figures do not include the past week's sell-off. Rising global bond yields are suggesting financial markets are much more optimistic about the economy than the Fed. "Powell is strongly optimistic about the economic outlook for the second half of the year, while the Treasury market seems to indicate that the recovery could take off in the second quarter," said Edward Moya, senior market analyst at OANDA. "If bond market selloff deepens with the 10-year breaking past 1.50%, that could prove to be disruptive for financial conditions." Besides the steepening yield curve, Pietronico said the political forecast is raising concerns among bond investors over inflation. "It is our view that the stimulus talk coming from Washington, D.C., is becoming counter-productive to the financial markets at this time as the economy seems to be on very solid footing already," he said. In the primary Wednesday, Maryland (Aaa/AAA/AAA/) sold $207.4 million of GOs to BofA Securities. Bonds in 2025 with a 5% coupon yield 0.43%, 5s of 2026 yield 0.54% and 5s of 2031 yield 1.13%. The second, $217.5 million of GOs, also went to BofA. Bonds in 2032 with a 5% coupon yield 1.20%, 5s of 2033 yield 1.26%, 5s of 2034 at 1.32%, 5s of 2035 at 1.39% and 5s of 2036 at 1.43%. The last, $50 million of taxable general obligation bonds, sold to Wells Fargo Securities. Bonds in 2024 yield 0.27% and 0.52% in 2025, priced at par. Maryland was trading even cheaper in the secondary Wednesday. Maryland GO 5s of 2024 at 0.32%. Maryland 5s of 2026 traded at 0.58%. Maryland 5s of 2031 traded at 1.14% versus 1.09% Wednesday. Brookline, Massachusetts, (Aaa/AAA//) sold $167.9 million of general obligation municipal purpose loan of 2021 bonds to BofA. Bonds in 2024 with a 4% coupon yield 0.10%, 4s of 2026 at 0.54%, 3s of 2031 at 1.13%, 2s of 2036 at 1.83%, 2s of 2041 at 2.05% and 2s of 2046 at 2.27%. The Regents of the University of California (Aa2/AA/AA/) priced several large deals with Jefferies LLC running the books on all of them. Jefferies priced $1.09 billion taxable general revenue bonds in two series. The first, $615.6 million, had bonds in 2022 yield 0.163%, 0.87% in 2026, 1.997% in 2031, 2.447% in 2036, 2.847% in 2041 and 3.146% in 2051, all priced at par. The second series, $475 million, yield 3.071% in 2051 at par. Jefferies priced $290 million of exempt general revenue bonds. Bonds in 2022 with a 3% coupon yield 0.13%, 5s of 2026 at 0.53%, 5s of 2031 at 1.07%, 5s of 2036 at 1.40%, 4s of 2041 at 1.88%, 4s of 2046 at 2.02%, and 4s of 2051 at 2.07% It was unclear whether the issuer priced $892.9 million of limited project revenue bonds; $448.9 million of taxable limited project revenue bonds; and $397.4 million of limited project forward delivery revenue bonds. BofA priced $258.2 million of refunding revenue bonds for the Sacramento County Sanitation District Financing Authority, California, (Aa2/AA/AA-/). Bonds in 2021 with a 5% coupon yield 0.17%, 5s of 2026 at 0.64%, 4s of 2031 at 1.25%, and 3s of 2034 at 1.73%. BofA priced $139 million of general revenue forward delivery bonds for the Nebraska Public Power District (A1/A+/A+/). Bonds in 2023 with a 5% coupon yielded 0.55%, 5s of 2027 at 1.14%, 5s of 2031 at 1.66%, 5s of 2036 at 1.98% and 5s of 2041 at 2.18%. Piper Sandler & Co. priced $108.7 million of unlimited tax school building bonds, PSF guaranteed, for the Clear Creek Independent School District (Aaa//AAA/). Bonds in 2022 with a 5% coupon yield 0.16%, 5s of 2026 yield 0.62%, 5s of 2031 at 1.22%, 3s of 2036 at 1.63% and 3s of 2041 at 1.83%. Trading Minnesota GOs 5s of 2023 traded at 0.19%. Maryland GO 5s of 2024 at 0.32%. Virginia Beach 5s of 2026 at 0.57% versus 0.38% on Feb. 17. Howard County, Maryland, 5s of 2028 at 0.88% versus 0.54% on Feb. 17. New York City GO 5s of 2029 at 117%. University of Texas 5s of 2030 at 1.14% versus 84.3% on Feb. 17. Washington GO 5s of 2031 at 1.24%. Washington 5s of 2032 at 1.30% versus 0.94% on Feb. 17. Iowa green 5s of 2034 at 1.39%. Water Environment, Oregon, 5s of 2032 at 1.41%-1.38% versus 0.86% original. Washington GO 5s of 2039 at 1.62% versus original 1.22%. New York City Transitional Finance Authority 5s of 2038 at 2.16%-2.13%, 4s of 2039 at 2.20%-2.07% versus 1.58% on Feb. 11. NYC TFA 4s of 2040 traded at 2.24%-2.11% versus 1.74% on Feb. 17. New York City water 5s of 2041 at 1.88%-1.87% versus 1.60% Friday. Texas water 4s of 2045 at 1.82%-1.71% versus 1.49%-1.43% on Feb. 17. Massachusetts GO 5s of 2050 at 1.95% versus 1.86%-1.85% Friday. Economy The highlight of the day was Federal Reserve Board Chair Jerome Powell's second day of testimony before Congress, before the House Financial Services Committee on Wednesday. "What stands out in Powell's testimony is what it does not mention, more so than what is included," said Berenberg Capital Markets Chief Economist for the U.S. Americas and Asia Mickey Levy. "The Fed is silent on any risks involved in its monetary policy, and how it may respond if things change and do not follow the Fed's script." With Powell pointing to uncertainties ahead and these two Congressional panels "charged with supervising the Fed," he asserted, "the Fed's semi-annual report and Chair Powell's testimony should have mentioned that the Fed is following potential risks and balancing them with its mandated objectives." New home sales grew 4.3% in January to a 923,000 seasonally adjusted annual rate from an upwardly revised 885,000 in December and 774,000 a year ago. The December figure was originally reported as 847,000. Economists polled by IFR Markets expected 855,000 sales. Only the Northeast region saw fewer sales in January, a 13.9% drop to 31,000 from 36,000 a month earlier. The median sale price fell about $7,000 to $346,400, while the average price was up about $14,000 to $408,800. "With existing home inventory at all-time lows, the demand for new construction remains strong," said National Association of Home Builders Chief Economist Robert Dietz. "Though, rising building and development costs, combined with recent increases in mortgage interest rates, threaten to exacerbate existing affordability conditions. Builders are exercising discipline to ensure home prices do not outpace buyer budgets." ICI reports record $2.921 billion more inflows Long-term municipal bond funds and exchange-traded funds saw combined inflows of $2.921 billion in the week ended Feb. 17, ICI reported Wednesday.